Interact Analysis New application scenarios key to collaborative robot market success

Robot manufacturers need to be able to scale up production and develop new applications, and the logistics industry will play an important role in this growth trajectory.

The collaborative robot market in EMEA will rebound in 2H 2023, with a US recovery taking slightly longer.

- Collaborative robot market penetration to surpass 20% by 2032.

- While the market in EMEA will have recovered by 2H 2023, the US collaborative robot market will take a while longer.

- Universal Robots retains the lion’s share of the global cobot market.

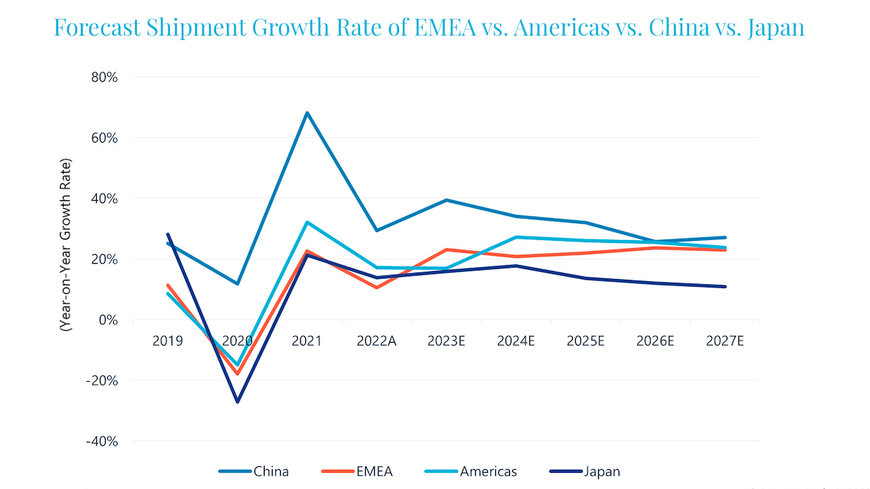

According to updated research by market intelligence firm Interact Analysis, the collaborative robot (cobot) market will enjoy modest growth out to 2032, with annual growth rates sitting at around 20%. As with all industries, the current economic landscape and the Ukraine-Russia war have had an impact on the collaborative robot market. Out to 2027, shipments of collaborative robots in EMEA will decrease from 19.5% to 15.9%, with a CAGR of 22.4%.

However, the CAGR for the Americas region will sit at 25.8%, and at 28.2% in APAC. 2022 and 2023 has, and continues to be, a difficult period for the US and European collaborative robot market as a result of inflation and ongoing supply chain disruptions. Interact Analysis forecasts that EMEA will begin to recover in the second half of 2023 and into the first half of 2024, while recovery in the US will take slightly longer, with a US manufacturing downturn expected in 2024.

The majority of collaborative robot vendors are what Interact Analysis refers to as ‘pure-play’ cobot vendors. This means collaborative robots are their main and only product line. Universal Robots retains its position as market leader, with AUBO, TechMan and JAKA following behind. Most of these vendors are based in the APAC region, with Chinese vendors increasing their share in the local market. South Korean manufacturers have also begun to emerge in the market since 2020, but their success has been largely tied to the local market because market entry is more difficult for overseas manufacturers.

“It’s promising to see that the application field for collaborative robots is widening. Maintaining this will be a key factor in future growth of the market. Deployment of cobots in the education, medical, logistics, catering and retail sectors is increasing due to the development of machine vision and machine learning software,” Maya Xiao, Research Manager at Interact Analysis, comments.

www.interactanalysis.com